| StockFetcher Forums · Stock Picks and Trading · Intraday Alerts | << 1 ... 1890 1891 1892 1893 1894 ... 1903 >>Post Follow-up |

| johnpaulca 12,036 posts msg #146244 - Ignore johnpaulca |

1/25/2019 9:39:50 AM FMCC....now at $3, I've held this since 2007(housing meltdown) at 0.35 |

| johnpaulca 12,036 posts msg #146245 - Ignore johnpaulca |

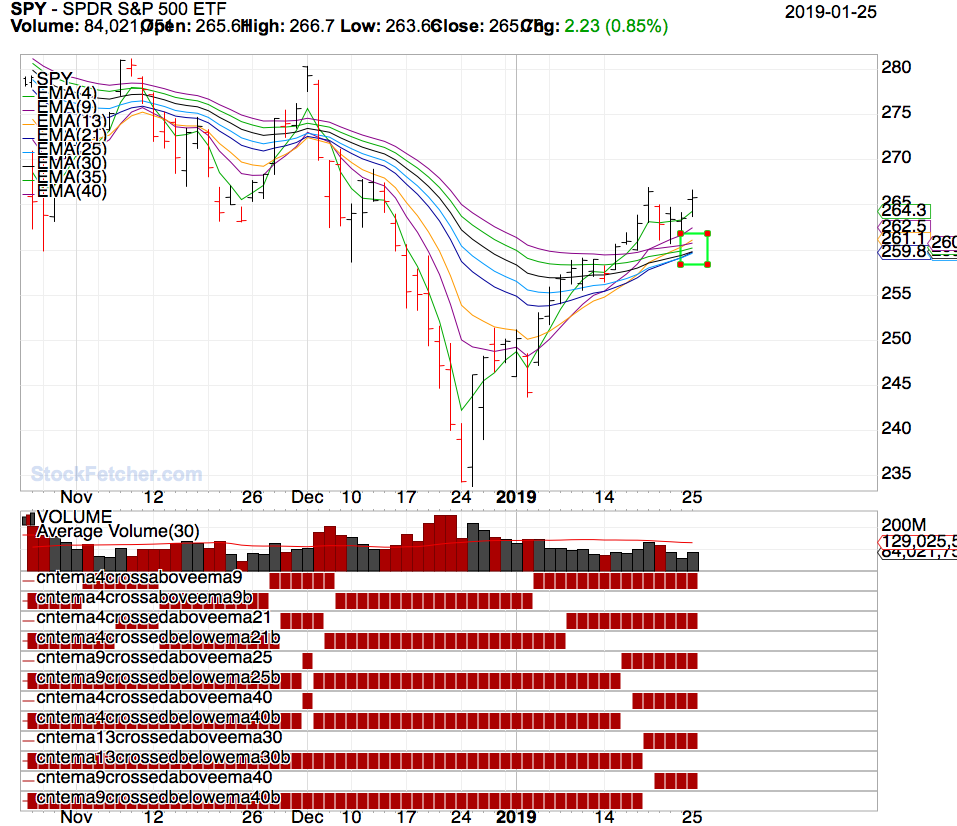

1/25/2019 9:45:56 AM SPY...nice bounce today, congrats to those who bought the dip. Resis will be on daily BB125(2671) |

| Mactheriverrat 3,172 posts msg #146256 - Ignore Mactheriverrat |

1/25/2019 4:31:56 PM @JP SPY - More good days to come.  |

| ron22 255 posts msg #146257 - Ignore ron22 |

1/25/2019 5:19:33 PM Mac, Would you be kind enough to post the filter that produced the SPY chart that you posted today? Thank you very much. This will save me the time of looking for it in numerous guppy posts or trying to create a filter that already exists. |

| Mactheriverrat 3,172 posts msg #146259 - Ignore Mactheriverrat |

1/25/2019 10:18:02 PM Submit |

| ron22 255 posts msg #146261 - Ignore ron22 |

1/25/2019 10:44:23 PM Mac, Thank you very much for posting the filter that I requested. Also, I really like it when you add comments within your posts and/or onto the charts that you post. It helps me understand the process. I realize now that the filter just picks the candidates. We have to choose which ones to buy, entry point and exit point. Thanks again. |

| johnpaulca 12,036 posts msg #146262 - Ignore johnpaulca |

1/25/2019 11:42:27 PM a more simplified version with candidates above $20 |

| ron22 255 posts msg #146267 - Ignore ron22 |

1/26/2019 9:19:20 AM JP, Interesting filter. Some filters that I use have RSI, but I never used RMI before. Your comments on charts are also helpful Thank you. |

| snappyfrog 749 posts msg #146276 - Ignore snappyfrog |

1/26/2019 9:42:15 PM Ron22, I agree. The RMI is interesting and I will have to play with it some. Thanks JP. |

| johnpaulca 12,036 posts msg #146286 - Ignore johnpaulca |

1/27/2019 12:16:21 PM If using this filter, an entry will be on stocks that only retrace at least 50% of the breakout bar or after the gap is filled. |

| StockFetcher Forums · Stock Picks and Trading · Intraday Alerts | << 1 ... 1890 1891 1892 1893 1894 ... 1903 >>Post Follow-up |